General News

Meropi Kyriacou Honored as TNH Educator of the Year

NEW YORK – Meropi Kyriacou, the new Principal of The Cathedral School in Manhattan, was honored as The National Herald’s Educator of the Year.

TNH’s 50 Wealthiest Greeks in America List 2022: Numbers 50-41

TNH’s 50 Wealthiest Greeks in America List 2022: Numbers 39-31

TNH’s 50 Wealthiest Greeks in America List 2022: Numbers 30-21

TNH’s 50 Wealthiest Greeks in America List 2022: Numbers 20-11

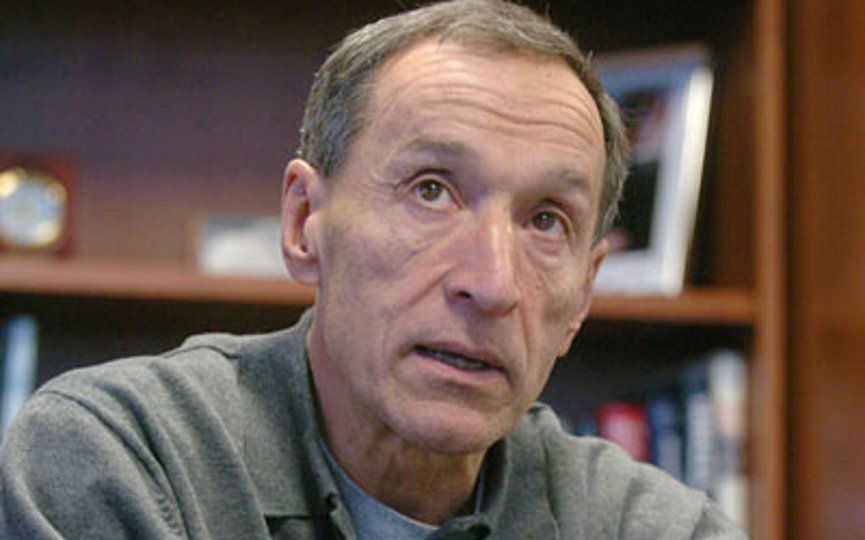

10. PETER J. BARRIS

Virginia

$1.95 BILLION (GuruFocus)

VENTURE CAPITAL

Northwestern University (Electrical Engineering); Married, 2 children

At 70, venture capitalist Peter J. Barris enjoys an impressive climb through the ranks of this year’s list, his fortune elevated on the wings of a wealth of investments guided by a honed acumen for launching and evolving companies. In 1992, following his tenure as President of LEGENT Corporation and Senior Vice President of the Systems Software Division of UCCEL Corporation, this venture capitalist joined New Enterprise Associates, Inc. (NEA), where he eventually served as managing general partner from 1999 to 2017. At NEA, Barris led investments in over 25 companies that have gone public or had successful acquisitions. Those investments include Groupon, CareerBuilder, WebMD, SalesForce, TiVo, Jet.com and Diapers.com.

Today, Barris serves as the Chairman of NEA. According to the NEA website, during Barris’ 18 years at the helm, the company’s assets grew from $1 billion to over $20 billion and the organization scaled its operations to become one of the world’s largest venture capital firms. The company, which started with offices in Maryland and California’s Silicon Valley, now has branches in Menlo Park and New York. NEA, founded more than 35 years ago, has $23+ billion in committed capital, 500+ companies and has completed 230 IPOs.

Under Barris’ leadership, NEA invested in industry-transforming technology companies like CareerBuilder, Tableau, Diapers.com, Groupon, Jet.com, Juniper Networks, Macromedia, Salesforce.com, TiVo, and Workday. NEA invested $14.8 million in Groupon early on and received $70 million back in 2011. That year, Groupon went public, reaping one of the greatest venture returns ever with an initial public offering value of $12.8 billion.

Barris serves on the board of public companies Groupon (GRPN) and Sprout Social (SPT) and is currently a director of several private companies including Berkshire Grey, Catalytic, NextNav, Tamr, Tempus, ThreatQuotient, Upskill, and ZeroFox.

Barris grew up in Chicago, IL. His father, James, was an engineer, and his grandparents were from Greece. His father encouraged Barris to follow the same career path that he did – but Barris had his eyes set on the law – more specifically, patent law – which he had heard required an engineering degree. Northwestern had excellent law and engineering schools, so he enrolled there. Eventually, he realized that patent law wasn’t where his passion lay but continued his studies of electrical engineering and then went on to earn his MBA from Dartmouth College. He eventually started his career in various management positions at General Electric Company where he spent almost a decade.

Barris has been named several times to the Forbes Midas List of top technology investors, to Crain’s Chicago 50 Top Tech Stars, to Washington Tech Council’s Hall of Fame, and to the Washington Business Hall of Fame.

Barris is Vice-Chair of the Northwestern University Board of Trustees and serves on the boards of In-Q-Tel and The Brookings Institute. Peter previously served on the Executive Committee of the Board of the National Venture Capital Association and was also a founding member of Venture Philanthropy Partners, a philanthropic organization in the Washington, DC area. Peter received his BSEE from Northwestern University and his MBA from the Tuck School of Business at Dartmouth.

Barris, a member of Leadership 100 and an Archon of the Ecumenical Patriarchate, lives in McLean, VA. with his wife, Adrienne. They have two daughters. His interests include traveling, skiing, “any and all Greek food,” boating, and spending time with his family.

9. PETER G. ANGELOS

Maryland

$2.0 BILLION (Celebrity Net Worth)

LAW, MAJOR LEAGUE BASEBALL

University of Baltimore; Married, 2 children

MLB fans in Maryland and around the United States, as well, probably know Peter G. Angelos, now 93, as the owner, chairman and former CEO of the Baltimore Orioles. However, Angelos found his way to success and fortune through the courtrooms.

Baltimore-based attorney Angelos was born in Pittsburgh, PA on July 4, 1929, to immigrants from the island of Karpathos. He moved to Baltimore at age 11, when his family settled in the Highlandtown section of the city. His father owned a tavern in East Baltimore where Peter worked during his adolescence. Peter learned very quickly how hard life could be – especially in Baltimore. Baltimore wasn’t a gentle environment to say the least; in order to protect himself, Peter learned how to box at the Baltimore Athletic Association. Years later, Peter graduated from the University of Baltimore School of Law, where he was class valedictorian, and went onto a lucrative career in trial law, specializing in cases involving harmful products, professional malpractice, and personal injury.

Following graduation, Angelos began working as a criminal defense lawyer. He founded his own practice in 1961, and in the 1980s, he shifted his focus from criminal law to civil class action suits. His law firm and wealth expanded exponentially in 1982, when he represented 8,700 plaintiffs – the largest number of plaintiffs ever – in an asbestos litigation and won. He reportedly made over $300 million on this one case alone. Angelos was also enormously successful in suing Wyeth, the makers of the diet pill fen-phen, and representing the state of Maryland as lead attorney in a lawsuit against tobacco company Philip Morris. The agreement had stipulated that he would receive 25% of the recovery, but when it came to $4.5 billion, Maryland refused to pay; Angelos’ team settled for $150 million.

Angelos bought the Orioles in August 1993, leading a group of investors including prominent Marylanders like novelist Tom Clancy, in purchasing the team for $173 million, a record price at the time. The Orioles enjoyed some success early under Angelos’ ownership, making the postseason as a wild card team in 1996 and winning the American League East Division title in 1997. They also enjoyed some success in the mid-2010’s but have since been in a period of ‘rebuilding’. In November of 2020, Forbes reported that the team is worth $1.4 billion.

Angelos and his wife, Georgia, have two sons: Louis, an attorney at the family law firm, and John, who has taken up the baton from his father as CEO of the Baltimore Orioles. Despite some recurring rumors of a move, “the Baltimore Orioles have stated publicly that they remain committed to Baltimore and to Maryland,” according to Thomas Kelso, chairman of the stadium authority, which is the landlord for the Orioles and Ravens on behalf of the state. John Angelos and other club executives have sought to assure Baltimore fans that the franchise is stable and intends to remain in the city. In 2019, John Angelos told a crowd of Baltimore business leaders that the team would stay in Baltimore “as long as Fort McHenry is standing watch over the Inner Harbor.” This promise has been renewed frequently as the team is said to be working on the current deal with the Maryland Stadium Authority, which currently sees them housed in Maryland until 2023.

A lifelong Democrat, Angelos has thrown his hat into the political arena as well. He won election to the Baltimore City Council and served on the Council from 1959 to 1963. He also ran for mayor as an independent in 1964, but lost. He has been an active supporter of national Democratic candidates and most recently, ESPN reported that Peter Angelos was among the top donors among MLB owners to either party over the last election cycle.

Angelos has been active in charitable programs in the city and state. He enjoys horse racing and owns thoroughbred horses. He has given $10 million to his alma mater, the University of Baltimore; in return, the new law school building bears the name of his parents: The John and Frances Angelos Law Center, which opened in April 2013. That same year, he donated $2.5 million to the MedStar Franklin Square Medical Center in Baltimore to open a lung disease center.

7. AMB. GEORGE L. ARGYROS

California

$2.4 BILLION (Forbes)

REAL ESTATE, SPORTS

Chapman University (Business & Economics); Married, 2 Children

George L. Argyros is well known in a wide variety of prominent circles, as his long and illustrious life has included achievements ranging from real estate, to sports, to international diplomacy. Argyros served as U.S. Ambassador to Spain and Andorra and was an owner of the professional baseball team, the Seattle Mariners – which he sold in 1989. But Argyros, now 85, made his fortune in grocery stores and real estate.

A second-generation American of Greek descent, he was born in Detroit, MI and raised in Pasadena, CA. He worked his way through high school and college in southern California as a paperboy and grocery clerk. Argyros went into real estate in 1962, selling land at busy intersections to gas stations. Today, his privately held Arnel & Affiliates owns and manages 5,500 apartments and 2 million square feet of commercial space. Argyros also founded Westar Capital, a private equity firm, in 1987 and is a director of First American Financial Corp and Pacific Mercantile Bancorp. This past summer, Argyros made a splash in the news, as his 248-foot yacht, Huntress, had been sailing the Hudson.

In 2001, then-President George W. Bush appointed Argyros U.S. Ambassador to Spain. Argyros also served on the Federal Home Loan Mortgage Corporation (FreddieMac) under President George H.W. Bush.

A resident of Harbor Island in Newport Bay, CA, Argyros is a recognized business leader and philanthropist. He was the 1993 recipient of the Horatio Alger Award of Distinguished Americans, and a 2001 recipient of the Ellis Island Medal of Honor. In 1999 Chapman University’s School of Business and Economics was renamed honor of Argyros, who has been the longest-serving chairman of the university’s board of trustees. Argyros, a trustee of the Center for Strategic and International Studies, also serves as a Life Trustee for the California Institute of Technology, where he formerly served as Chairman of the Investment Committee. Ambassador and Mrs. Argyros initiated the first national college scholarship program exclusively for veterans who had served honorably in Operation Iraqi Freedom or Operation Enduring Freedom in Afghanistan. Military scholarships totaling 2,349 and valued at $11.74 million have been awarded to these veterans.

Argyros developed a friendship with scientist/inventor Arnold Beckman in California in 1962. Soon afterward, he began a 22-year service as chairman of the board of the Arnold and Mabel Beckman Foundation, which awards research grants in chemistry and the life sciences. In 2013, the foundation developed the Beckman-Argyros Award in Vision Research. The annual award offers a $100,000 prize and a $400,000 research grant to an individual who has made a significant achievement in vision research.

In January 2012, Argyros became a member of the Board of Regents of the Orange County Council Boy Scouts of America. In April 2011, he and his wife made a $5 million gift to an ambulatory surgery center at the University of California. In 2018, the Argyros family foundation pledged $7.5 million to renovate the Los Angeles Coliseum, home of the USC Trojans and, according to the Los Angeles Times, the foundation donated $750,000 to help get the Balboa Island Museum & Historical Society established in its new location in Newport Beach, CA.

The Argyros family is part of an estimated $17-million campus renovation for the Mariners Christian School in Costa Mesa. Their contribution went towards a new 900-seat auditorium (the Argyros Center for Worship and Performing Arts) and a redesigned gymnasium (Living Legacy Athletic Center). Additionally, in December of 2019, the Argyros family announced a surprise $5M donation to the South Coast Repertory, the Tony Award-winning theatre in Costa Mesa, CA. It is one of the largest single donations in the history of the theatre, which was founded in 1964.

The Argyroses have been one of the leading supporters of the Repertory since the 1970s. The family was also honored by the city of Costa Mesa in May of 2019 with a Lifetime Achievement Award for service to the community.

Most recently, Argyros donated $7.5 million to the Hoag Memorial Hospital Presbyterian in Newport Beach which will be directed towards the hospital’s nursing services. As per Forbes, they have also donated to political campaigns, including $100,000 to former President Donald Trump for the Trump Victory joint fundraising committee (October 15 to November 23, 2020).

Argyros is an Archon of the Ecumenical Patriarchate’s Order of St. Andrew the Apostle. He and his wife, Julia, have two children and seven grandchildren. Their third child, George Argyros Jr., passed away in August of 2020 as a result of a heart attack. He was only 55 years old.

7. GEORGE M. MARCUS

California

Net Worth: $2.4 Billion

REAL ESTATE

San Francisco State University (Economics); Married, 4 Children

Born George Mathew Moutsanas in 1941 on the Greek island of Evia during World War II, Marcus, now 81, emigrated to the United States at the age of 4. In the past year, Mr. Marcus has increased his fortune to an estimated total of $2.4B.

When the Marcus family arrived in the United States, it settled in San Francisco’s blue-collar Potrero Hill neighborhood, where, Mr. Marcus has said, his top priority was fitting in. It was in this neighborhood that Marcus eventually met his future wife, Judy, with whom he has four children. According to an interview with the Nob Hill Gazette, Marcus was friends with Judy’s younger brother – they knew each other since elementary school. However, it wasn’t until after Marcus came home from the military that his friend, Judy’s brother, suggested that he should go on a date with his sister.

Marcus completed his undergraduate studies in Economics at San Francisco State University (SFSU) in just two and a half years. He was named SFSU Alumnus of the year in 1989 and one of its 11 Distinguished Centennial Alumni in 1999. He and his wife (also an SFSU alum), helped create SFSU’s International Center for the Arts with a $3 million gift. Marcus also helped develop SFSU’s Greek Studies program, and chairs its Modern Greek Studies Foundation, which supports the Nikos Kazantzakis Chair for Modern Greek Studies.

Professionally, Marcus founded G.M. Marcus & Company, which evolved into Marcus & Millichap Company (MMC), with the help of his business partner, William A. Millichap (who passed away in June of 2020) four decades ago. MMC is one of the country’s premier providers of investment real estate brokerage services, and the parent company of a diversified group of real estate, service, investment, and development firms. It closes more transactions than any other brokerage firm in the country and has a market cap of approximately $1.23 billion. In October of 2020, MMC announced that it had agreed to acquire New York-based debt and equity brokerage Mission Capital.

MMC’s featured company, Marcus & Millichap Real Estate Investment Services, has established itself as a leading real estate firm with more than 2,500 brokers in markets throughout the United States. With more than 80 offices across the U.S. and Canada, the firm concentrates on investment brokerage, and provides financing and research services to both buyers and sellers.

Marcus & Millichap Real Estate Investment Services went public in October 2013. In 2015, due to the company’s success, Marcus’ net worth catapulted him from millionaire to billionaire.

Marcus is also chairman of Essex Property Trust, a publicly held, multi-family real estate investment trust (REIT). Located in San Mateo, CA and traded on the New York Stock Exchange, Essex is a fully integrated REIT that acquires, develops, and redevelops apartment communities in select west coast ocales. The company, according to Forbes, currently owns almost 60,000 apartments along the West Coast (with sales of $1.4 billion as of 2021).

In an interview with the Business Times about his companies, he said they started with “a good idea, a commitment to innovate and good people who have dedicated decades to do the job.” “Integrity has always been the key,” Marcus told the Business Times. “We were always trying to do something a little bit better than the rest and we have really well-trained people to do it,” he said. Later in the interview Marcus said, “I’ve never told someone what to do — but convinced them to do it.”

Along with another Greek-American couple, George and Judy Marcus opened the successful Evvia restaurant in Palo Alto in 1995, and its sister restaurant Kokkari in San Francisco in 1999.

Marcus supports many organizations of the Greek-American community. In 2008, he co-founded and is the current Chairman Emeritus of the National Hellenic Society, which brings together distinguished Greek-Americans on a national level to preserve their heritage. His considerable commitments to the Greek Orthodox Church and the Community include memberships on the boards of directors of the Modern Greek Studies Foundation, the Greek Orthodox Metropolis of San Francisco, International Orthodox Christian Charities, the Elios Society of Northern California, Leadership 100, and many others. He is also involved with The Hellenic Initiative, the Washington ‘Oxi’ Day Foundation, and the United Religions Initiative. In February 2017, The National Herald reported that Marcus donated $1 million to the Hellenic College and Holy Cross Theological School (HCHC) in Massachusetts. Last year, he donated another $2 million (in addition to the $1 million he had already donated) towards the rebuilding of the St. Nicholas Greek Orthodox Church and National Shrine at the World Trade Center in Manhattan.

The Marcuses also support non-Greek causes as well. In 2018, they gave San Francisco State University a $25 million gift to benefit the school’s liberal arts program (the largest grant ever given to that institution). In 2019, they gave $10M to Cristo Rey San Jose Jesuit High School which will be used to establish an endowment – a gift that the school’s president calls “transformational.”

The Marcuses have also been major political donors, mostly to Democratic and liberal causes. Most recently, Marcus has become one of Joe Biden’s largest donors (according to Forbes). It was reported that he donated $4 million to Biden’s campaign and the pro-Biden super PACs. Recently, it was also reported that Marcus made a $1M contribution to the House Majority PAC, in support of maintaining the US House of Representatives under Democrats’ control.

6. DEAN METROPOULOS

Florida

$2.7 BILLION (Forbes)

MANAGEMENT, ACQUISITIONS

Babson College; Married, 2 Children

At 75, C. Dean Metropoulos is a constant presence on this list, continuing to expand his portfolio of investments as Chairman and CEO of Metropoulos & Company, a boutique buyout and management firm.

Born in Greece, Metropoulos moved with his family to Massachusetts at the age of 10. His business ventures started when he was 32 years old, and purchased a cheese company in his wife Marianne’s native Vermont. Ever since, Metropoulos, a prominent member of the Greek-American community, has also been a household name in the United States through his involvement in brands that have become staples of everyday American life, and which include Hostess, Pabst Blue Ribbon Beer, Chef Boyardee, Ghirardelli Chocolate, Pinnacle Foods, Bumble Bee Tuna, Vlasic Pickles, Cadbury, Aunt Jemima, and Utz Snacks.

Through this series of acquisitions and investments, Metropoulos has made himself known in the private equity, investment banking, and financial communities, having spent nearly three decades creating, acquiring, restructuring, and growing over 80 different businesses and 300 brands in the United States, Mexico and Europe, for a combined estimated capital of approximately $14B. A year ago, Metropoulos added the Poland Spring, Deer Park, Zephyrhills, Pure Life, and others brands to his business, when Nestle S.A. sold North American Waters brands to him and One Rock Capital in a $4.3 billion deal.

One of his famous deals was in July 2013 when Metropoulos paid $410 million to buy Hostess Brands and return Twinkies to grocery shelves after the company had filed for bankruptcy protection and closed its doors. Since then, Hostess has made a remarkable turnaround; in the past few years it has released several ice cream flavors and rolled out a new upscale line of snacks. In 2016, The Gores Group (see the Gores Brothers supra) acquired Hostess via a spin-off, under a special-purpose acquisition company process – but Metropoulos remained chairman until the end of 2020. Today, the Hostess company is worth more than $2B, and Metropoulos is rumored to be partnering with Alec Gores again for a foray into the NFL. In 2019, Metropoulos had joined Gores again to take blank check company Gores Metropoulos public.

Metropoulos has cited sons Evan, 41 and Daren, 39, as “the creative catalysts for repositioning and reinventing” the brands he has acquired through them, crediting them with the success of their turnarounds.

Growing up as the child of immigrant parents who emphasized the potential of hard work in the United States, Metropoulos has remained as committed to the Greek-American community as he is to hard work. He and his wife are both members of the Leadership 100 endowment fund, an organization that supports the activities of the Greek Orthodox Church in the United States. Metropoulos is also a trustee of the National Hellenic Museum located in Chicago and a founding member and president of Faith Endowment, a New York based organization promoting the Greek Orthodox religion and Hellenic culture and interests. Metropoulos has been honored by the International Foundation for Greece (IFG), as well as by the Hellenic Post, which issued stamps dedicated to him.

5. JOHN PAUL DeJORIA

California

$2.8 BILLION (Forbes)

HAIR CARE PRODUCTS, SPIRITS Married, 6 Children

Even John Paul DeJoria’s net worth, increased by $100M this past year, is outshined by his embodiment of the American Dream. This Greek-American billionaire’s path to success was not a straight line; instead he had to support his family from an early age, by selling Christmas cards door-to-door, and by delivering newspapers with his brother. The son of an Italian immigrant father and a Greek immigrant mother, DeJoria was placed in a foster home after his parents’ divorce, when his single mother struggled to provide for their family. Until nine years old, DeJoria would spend his weekdays away from his mother. From these humble beginnings, he went on to serve in the U.S. Navy for two years, before holding a series of jobs, including as a janitor, a gas station attendant, an encyclopedia salesman, and an insurance salesman. When he lost his job as an encyclopedia salesman, a job he credits with teaching him everything about business, he could only find work as an announcer at a local racetrack. By then he was married and had his first baby. But the financial difficulties were such that his wife abandoned both of them when they were evicted from their home, taking all their savings with her. Suddenly, DeJoria and his baby son were homeless.

His road to success started to form when he got a job at Redken Laboratories. A career as consultant with several hair care and cosmetic companies began, and in 1980, DeJoria teamed up with his friend Paul Mitchell to launch John Paul Mitchell Systems, a line of high-end hair care products. Mitchell only had $350 dollars to launch the company; DeJoria, who was living in his car at the time borrowed an equal amount from his mother. After two years of hand-to-mouth work, the company grossed $1 million. The John Paul Mitchell Systems hair products company, still privately held, is worth more than a billion dollars. They are available in more than 100,000 salons in the United States and are distributed throughout the world.

In 1989, DeJoria was doing much better than he ever imagined. So much so, that when his friend Martin Crowley came back from Mexico with news of the best tequila he had had in his life, DeJoria was able to invest in it. Confident in the brand’s premium profile, they launched it at a market-leading price, only to have their expectations confirmed by the success of Patron tequila, now a leader around the world. Clint Eastwood, a friend of DeJoria’s, placed it in his film In the Line of Fire, celebrity chef Wolfgang Puck endorsed it, and DeJoria gave it away at John Paul Mitchell events. Eventually, the original ultra-premium tequila was acquired by Bacardi Limited for $5.1 billion in 2018.

In June 2014, DeJoria co-founded (with British entrepreneur Jonathan Kendrick) ROK Mobile, a music streaming service combined with a contract free mobile phone plan offering unlimited voice, text, and data. On March 20, 2019, ROKiT (part of ROK Mobile) announced a line of five mobile handsets, including three smartphones, to market (sold at ROKit.com and Walmart.com). Unlike other phones, these are paired with vital life services like family telemedicine, legal counsel and more. ROKiT unveiled its first fully functioning WiFi City in Austin, TX. The company enables free WiFi and online streaming services to the residents of Community First! Village which provides affordable, permanent housing and a supportive community for men and women coming out of chronic homelessness. The ROKiT team announced that they are expanding their services to other countries throughout North, Central, and South America, as well as Africa and Asia.

Despite the challenges she faced, DeJoria’s mother made sure to instill in her children a sense of responsibility to the community. DeJoria has been quoted telling a story that when he was 5, and without money to spend on Christmas presents, she gave him and his brother money to give to the Salvation Army. The amount was not insignificant in 1950, certainly not to a family that was fighting to make ends meet. “They need it more than we do,” his mother said, engraining in DeJoria’s mind the attitude that “success unshared is failure” – his life’s motto.

DeJoria contributes to more than 160 charities, which include the Boys & Girls Clubs of America, the American Cancer Society, food banks Loaves & Fishes, Food4Africa, Grow Appalachia, and Chrysalis, a nonprofit group that helps homeless and low-income people get back on their feet and find the path to self-sufficiency. In the context of his support for Food4Africa, in 2008 DeJoria traveled for Africa to join Nelson Mandela in his efforts to provide food for 17,000 orphans. DeJoria is also a patron of Mineseeker, a non-profit organization dedicated to seeking solutions to the worldwide problem of landmines, as well as Peace Love and Happiness LTD which is “committed to contributing to a sustainable planet through investing in people, protecting animals and conserving the environment.”

In response to the homeless crisis in America, DeJoria has brought together a community called Mobile Loaves and Fishes which has constructed 250 small homes in the city of Austin, TX for those who have been sleeping on the streets for over a year. Homeless people pay $90 per month for their small homes but are prohibited from drinking alcohol and fighting. The program also affords the homeless the opportunity to learn skills and earn money; it offers wood shop, auto shop, metal shop, crafts, and gardening. This training allows them to earn an income and their gardens allow them to eat organically. DeJoria noted that the program is working so well that they will be adding an additional 400 homes to the project. Mobile Loaves & Fishes counts on the support of 19,000 volunteers.

DeJoria has also been distinguished by his response to the pandemic: The John Paul Mitchell Systems produced hand sanitizer to help stop the spread of the COVID-19 virus which was donated to high-need groups who are facing shortages, such as Southern California first responders, Los Angeles police officers, and low-income families with young children. The company also enacted a relief program called the JPMS Salon Jumpstart Stimulus package, valued at $4 million.

Today, DeJoria is on lists of the world’s billionaires, and one of America’s richest living veterans. One of the remarkable luxuries in his life is the private, 85-foot long train car, the Patron Tequila Express, which is open only to his personal guests. He and his third wife, the former Eloise Brady, are based in Austin, TX. DeJoria has six children, one of whom is professional drag-racer, Alexis DeJoria.

4. JOHN A. CATSIMATIDIS

New York

$3.7 BILLION (Forbes)

OIL, REAL ESTATE, SUPERMARKETS

New York University; Married, 2 Children

Increasing his personal estimated fortune by almost a full billion dollars, John A. Catsimatidis remains one of the richest Greek-Americans, and a prominent public figure in the Greek-American community and beyond.

From the small Greek island of Nisyros, Catsimatidis’ family moved to an apartment in Harlem when he was an infant. He attended New York University, but withdrew before receiving his degree in electrical engineering, much to the dismay of his father, in order to own a piece of the grocery shop where he worked. A true self-made billionaire owing his success to decades of personal hard work and innovation, Catsimatidis opened his first grocery store in 1969, reaching the age of 24 with ten stores for an annual revenue of $25 million.

Perhaps best known for his Gristedes supermarket chain in New York, Catsimatidis’ diverse investments include real estate, oil, and other industries. Early on, he turned a $5 million Manhattan real investment into $100 million – in just five years. His involvement in oil begun when he purchased United Refining in Warren, PA, buying it out of bankruptcy for $7.5 million. Since then, the firm has grown to 375 gas outlets and convenience stores in Pennsylvania, New York, and Ohio.

Catsimatidis is chairman and CEO of the Red Apple Group, which is among the country’s largest privately held companies that has holdings in the energy, aviation, retail, and real estate sectors with 8,000 employees. With a major focus on energy, Catsimatidis’ fortune accelerated with rising oil prices. Catsimatidis also hosts a weekly talk radio show, the Cats Roundtable, during which he interviews people involved in politics. The New York Post recently included Catsimatidis among the figures the Republican party depends on to counter the support George Soros gives to the Democrats.

Catsimatidis’ most recent projects include building mixed-use developments in Brooklyn’s Fort Greene and Coney Island neighborhoods. Meanwhile, his planned $300 million complex in St. Petersburg, FL, which will include a 46-story condo tower, with residential and office spaces, along with 20,000 square feet of ground-floor retail space, has recently surpassed $150M in reservations during the first 90 days of sales.

Always an active member of the Greek-American community, Catsimatidis has continued his stewardship of the St. Andrew Ecumenical Patriarchal Fund, and his support for the St. Nicholas Greek Orthodox Church and National Shrine.

Catsimatidis has also helped raise millions for Alzheimer’s, Parkinson’s, and Juvenile Diabetes research and is on the board of Columbia Presbyterian Hospital and the Hellenic Times Scholarship Fund. Since 1988 he has funded scholarships at the NYU School of Business. Catsimatidis is married to Margo and is the father of two children, Andrea and John.

3. HASEOTES FAMILY

Massachusetts

$3.9 BILLION (BizJournal)

CONVENIENCE STORES

Jumping five spots since last year, the Haseotes family has come a long way from their one-cow, one-calf Rhode Island farm.

Their story starts with Vasilios and Aphrodite Haseotes who founded Cumberland Farms in 1938. The Haseoteses emigrated from Greece’s Macedonia and Epirus regions to the state of Maine and eventually proceeded to purchase their (now famous) one-cow, one-calf dairy farm in Cumberland, RI for $84. They had eight children, two of whom – Demetrios (Jim) and Lily – would go on to lead the convenience store chain.

Cumberland Farms eventually expanded across state lines and grew to become the largest dairy farm operation in Massachusetts. In 1956, the company opened a jug-milk store in Bellingham, MA after realizing that there were few convenience food stores with daily dawn-to-midnight service in the northern part of the country. In 1962, Cumberland Farms quickly expanded to become New England’s first true convenience store.

By the early 1990s, Cumberland Farms ranked third among the country’s convenience store chains, and was also a leader in both the retail and wholesale distribution of petroleum products through the Cumberland Farms (and previously, also Gulf and Mobil) names. The company first added a gas station to one of its stores in 1971 and expanded greatly in the wake of the 1973-74 Arab oil embargo.

Today, Cumberland farms has almost 600 stores in 8 states and employs over 6,000 people. Until October of 2019, Cumberland Farms was one of America’s largest family-owned convenience store chains – and one of the largest family-owned companies of any kind in the United States. Lily Haseotes Bentas, daughter of Vasilios and Aphrodite Haseotes, served as chairman of the board of directors and her nephew, Ari, succeeded her as CEO in June 2014.

In 2019, EG Group, a United Kingdom-based company, officially bought Cumberland Farms. At the closing, Ari Haseotes said: “Being a third generation founding owner and operator, I have an immense amount of gratitude for the Cumberland Farms team and what we have achieved together,” he said. “This is the right next step for Cumberland Farms and creates an incredible opportunity to expand and grow the existing business into the wider EG Group global network. In that regard, I couldn’t be more pleased with the historical milestone achieved today.”

Two members of the Haseotes family made large real estate investments recently: Byron G. Haseotes Jr. (grandson of Vasilios), paid $11.12 million through a land trust for a newly built waterfront spec home in Boca Raton, and Vasilios S. Haseotes II (another grandson of Vasilios) bought an equestrian estate for $8.2 million in Wellington, FL.

Another member of the Haseotes family, Demetrios, started Midland Farms in 2002, now a large New York-based fluid dairy processor. He moved to Pulaski County in Kentucky in 2012 after purchasing the former Somerset Refinery – now Continental Refining Company (CRC) – and investing over $40 million in updating and improving the facility’s crude oil refining capabilities. A few months ago Demetrios announced that CRC would not resume refining crude oil but said that he is exploring plans to invest an additional $25 million to acquire, relocate, and install a soybean crushing biodiesel refining and blending facility at the current CRC oil refinery. According to the Commonwealth Journal, in October of 2020, Demetrios also announced that he and three other people were looking to start a four-year university (from scratch) in Somerset, KY.

2. Jim Davis & Family

Massachusetts

$5.5 BILLION (Forbes)

NEW BALANCE

Middlebury College (Biology/Chemistry); Married, 2 Children

A good mind is a terrible thing to waste, as goes the saying –and changing it once in a while can really help make sure that does not happen, as is proven by Jim Davis, who initially thought he would work in medicine before changing his mind to go into sales, and who initially passed on buying the New Balance footware company before changing his mind to find himself heading what is now estimated to be one of the biggest names in that industry, with $3.6B in sales.

Now 78, this Massachusetts-born son of Greek immigrants started out working as a ‘lumper’ carrying trays for his father’s restaurants. Having received a degree in Biology/Chemistry from Middlebury College, Davis planned to work in medicine, but one of his professors suggested his talent might be in sales. Following a brief sales career, Davis decided to run his own company, and eventually bought New Balance, then a 6-employee firm in Boston, turning it into a major footwear and apparel brand with manufacturing facilities in the United States, the United Kingdom, and Europe, and a workforce of almost 5500.

In 1976, the company began soaring to new heights with the development of the New Balance 320 running shoe. The running culture in Boston, combined with Davis’ acumen and his expanding its business in major United States markets quickly established the brand. The company remains private, with Davis and his wife, Anne, who joined the company in 1978, retaining 95% of the company for their family.

As part of its pandemic response, New Balance has had to furlough some of its retail, factory, and office workforce, while Joe Preston, New Balance president and CEO, said senior-level associates saw salary reductions, and he himself saw a 50 percent salary cut. The company also converted some of its manufacturing facilities to produce face masks in the earlier stage of the pandemic.

Ever a Boston brand, in April of 2019, NB Development Group broke ground on The TRACK at New Balance near Boston Landing, featuring a multi-sport athletic complex spanning a city block, as well as a concert venue with The Bowery Presents (with room for up to 3,500 fans) and a New Balance Athletics Sports Research Lab. The complex is expected to open to the public in 2022. Meanwhile, New Balance Athletics have a 10-year agreement in place with Boston College as the Official Footwear and Apparel Provider for the Eagles, the name of the school’s athletic teams. All this, of course, is in addition to New Balance being an official marketing partner of the NBA.

According to an interview he gave to Sports Business Daily, Davis, who has supported President Trump, is a Rolling Stones fan who collects cars, and enjoys vacations on the north shore of Boston.

1. The Gores (Georgious) Brothers

California

$7.5 BILLION (Forbes)

EQUITY INVESTMENT, SPORTS, TECHNOLOGY, LEVERAGED BUYOUTS, ENTERTAINMENT

An extraordinary family journey keeps the Gores brothers at the top spots of our 50 Wealthiest list through the past years, highlighting the potential of humble beginnings to lead to triumph. Born to a Greek father and a Lebanese mother in Nazareth, Israel, they moved to the United States in 1968, and were supported by family to settle in Genesee, MI. The brothers’ net worth, presented here combined, as a tribute to their impressive, collective success, surpasses $7.5B, tells the story of how Elias, Samir, and Tewfic arrived to the United States, their names changed to Alec, Sam, and Tom, and their lives changed to exemplars of self-made success across a variety of ventures.

Initially stocking shelves for 25 cents/hour at their small family grocery in Flint, MI, the Gores brothers now enjoy the fruits of the sacrifice made by their parents over 50 years ago, and which Alec described in interview with Forbes, saying, “my father was willing to give up literally everything he had [in Israel] and pack his bags and bring us here … He did it for the kids, to make sure we have a better future… The day we landed in America, my dad sat us down and he said, ‘this is your new country. You have to respect it. You have to embrace it. You’ve got to work hard, and you can do anything you want in this country.’” It looks like they listened.

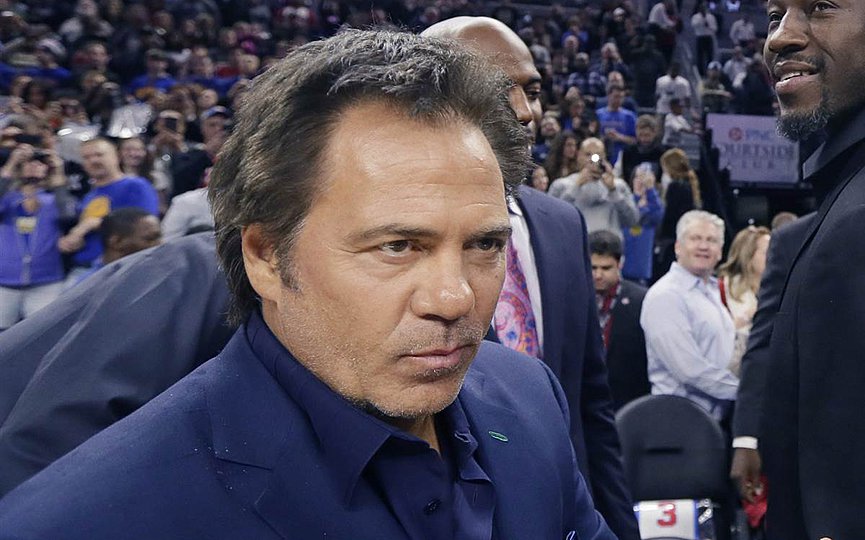

Tom Gores:

Through Platinum Equity, his Los Angeles-based private equity firm, and with personal net worth of $5.9B, Tom Gores oversees more than 40 companies with some $26B in assets. Founded in 1995, Platinum Equity is one of the largest private companies in the United States and has offices in California, New York, Boston, London, and Singapore.

Since 2016, Tom has been the sole owner of the National Basketball Association’s Detroit Pistons, after buying out Platinum’s stake, acquired in 2011. With his financial backing, the team’s $90M new headquarters and training center opened in September 2019.

With an interest in the arts, and a commitment to charity, including FlintNow, which he launched in 2016 to address the water crisis in his hometown of Flint, MI, Gores has nonetheless been the subject of intense criticism over Platinum Equity’s acquiring of Securus, an industry leader in providing telecommunications to incarcerated individuals. The company has been criticized for its exorbitant rates for phone calls – and the burden of that cost is borne by the families, who are struggling even more to keep in contact with their friends and loved ones during the pandemic. In an interview with the Detroit Free Press, Tom said Platinum Equity purchased Securus because the firm viewed the company as a “sound investment,” stressing, however, that he had changed his mind to say “this industry really should be led probably not by private folks. I think it probably should be – I’ll get killed for saying this – but the nonprofit business, honestly.” The criticism around his involvement with Securus led to Gores’ resignation from the Los Angeles County Museum of Modern Art board of trustees.

Despite the Securus controversy, Gores has recently renewed his long-standing commitment to giving back to the community, this time partnering with the U.S. Marines and volunteers of the Marine Corps Reserve Toys for Tots Program, to provide toys to more than 1800 families this past holiday season.

Tom, his wife, Holly, and their three children live in Beverly Hills, CA, but also maintain a home in Birmingham, MI.

Alec Gores:

Now boasting a personal net worth of $2.6B, Alec Gores got his professional start in business at General Motors, where he quit to launch Executive Business Solutions, selling computers out of his basement. His father “gave [him] his last $8,000 and had [him] go buy a demo machine,” Alec told Forbes. “That’s what I needed to start the business.” In 1986 Alec eventually sold that company to Contel for approximately $2 million, and a year later he founded the Beverly Hills-based private equity firm The Gores Group, through which he has made over a hundred transactions totaling over $500M in assets. Gores is involved in many special purpose acquisition companies (SPACs), and has gained a 6% stake in leading lending company United Wholesale Mortgage.

In 2016, he joined C. Dean Metropoulos, also featured in this edition, to take the food snack giant Hostess public but has since sold the majority of his stake. Recently, he has been rumored as a potential bidder for the Denver Broncos, joining forces with Dean Metropoulos and Mat Ishbia.

The first person in his family to finish college, Alec Gores graduated from Western Michigan University with a degree in computer science. Now a father of six, and married to Kelly Noonan Gores, he lives in an 11-bedroom mansion on 2.2 acres in Beverly Hills – near his brother Tom, who bought a palatial estate in Holby Hills in 2016 as part of a reported $100 million deal.

Alec famously lost over $17 million in a three-day backgammon series to fellow billionaire JP McManus in 2012, the Independent reported, and Gores promptly “paid up like a gent.”

Sam Gores:

Sam Gores started out as an agent at the Gage Group before founding SGA Representation, eventually to become Gores/Fields. Through a series of mergers and calculated expansion into different fields of the entertainment business, Sam founded Paradigm Talent Agency, of which he remains chairman. The company represents thousands of creators in music, TV & Film, the theater, and literature, with some of the most well-known names in its music division alone currently including Billie Eilish, Shawn Mendes, Sia, Imagine Dragons, Kacey Musgraves, Mark Ronson, The Prodigy, Pusha T.

Following the laying off of a large portion of Paradigm’s staff during the pandemic, Gores was named in a lawsuit alleging misconduct, but has responded with a counter lawsuit, denying all allegations. Paradigm’s response to the pandemic has included Sam’s brother, Tom Gores, joining the company through Crescent Drive Media.

Paradigm recently announced it will be subletting its Beverly Hills headquarters as it transitions to a hybrid work model.

A member of the Academy of Motion Picture Arts and Sciences, the Academy of Television Arts and Sciences, and the Recording Academy, Sam Gores also serves as a Trustee at the American Academy of Dramatic Arts and is on the board of Geffen Playhouse.

Sam has donated to the Children’s Hospital of Los Angeles. He is also an active participant in Conservation International and Hand in Hand: Center for Jewish Arab Education in Israel which builds schools in Israel for both Jewish and Arab children.

NEW YORK – Meropi Kyriacou, the new Principal of The Cathedral School in Manhattan, was honored as The National Herald’s Educator of the Year.

MELBOURNE, Australia (AP) — More than 100 long-finned pilot whales that beached on the western Australian coast Thursday have returned to sea, while 29 died on the shore, officials said.

On Monday, April 22, 2024, history was being written in a Manhattan courtroom.

PARIS - With heavy security set for the 2024 Paris Olympic Games during a time of terrorism, France has asked to use a Greek air defense system as well although talks are said to have been going on for months.

PARIS (AP) — Paris has a new king of the crusty baguette.

WASHINGTON (AP) — A tiny Philip Morris product called Zyn has been making big headlines, sparking debate about whether new nicotine-based alternatives intended for adults may be catching on with underage teens and adolescents.